Your CRM enables you to accept credit card or ACH payments from your clients right from the lead. If needed, you can also set up recurring billing.

The payments are processed using Credit Card Profiles or Paya ACH Profiles which can be pre-configured in the CRM administration or created from the lead on the fly.

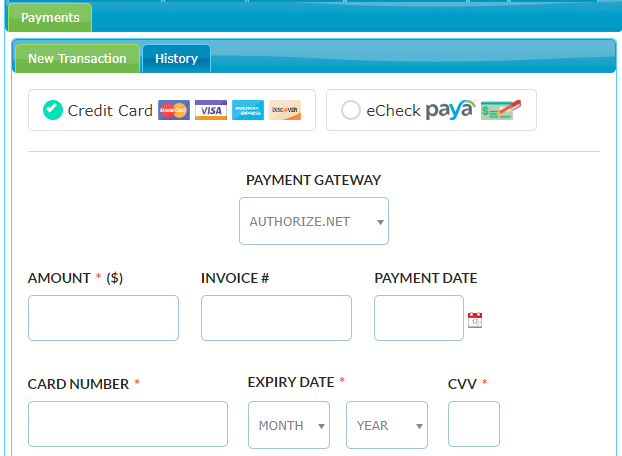

To charge a client open the Payments tab on the lead page, select the Credit Card or eCheck Paya option, fill in the required information, and submit the transaction.

You can check on the status of your transactions on the History tab, where you can also void transactions or issue refunds.

If a profile has not been set up for a particular client, you can enter the client's credit card or ACH information on the Payment tab.

After you submit the transaction a new profile will be automatically created and saved for future use.

In this article, we'll show you how to enable the Payments tab on your lead, submit credit card or ACH transactions, and manage recurring billing and transaction history.

The Payments tab is also shown on the Merchant Details page under the Profile tab.

Enabling The Payments Tab

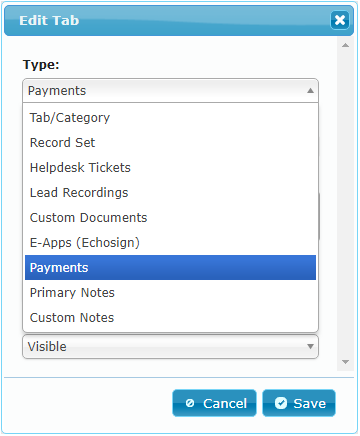

The Payments tab can be enabled on your lead by your administrator from the Manage Lead Fields page.

The tab type should be set to Payments as shown in this screenshot:

There can be only one Payments tab on the lead.

Once the Payments tab is enabled, it will not be possible to add another tab with the Payments type.

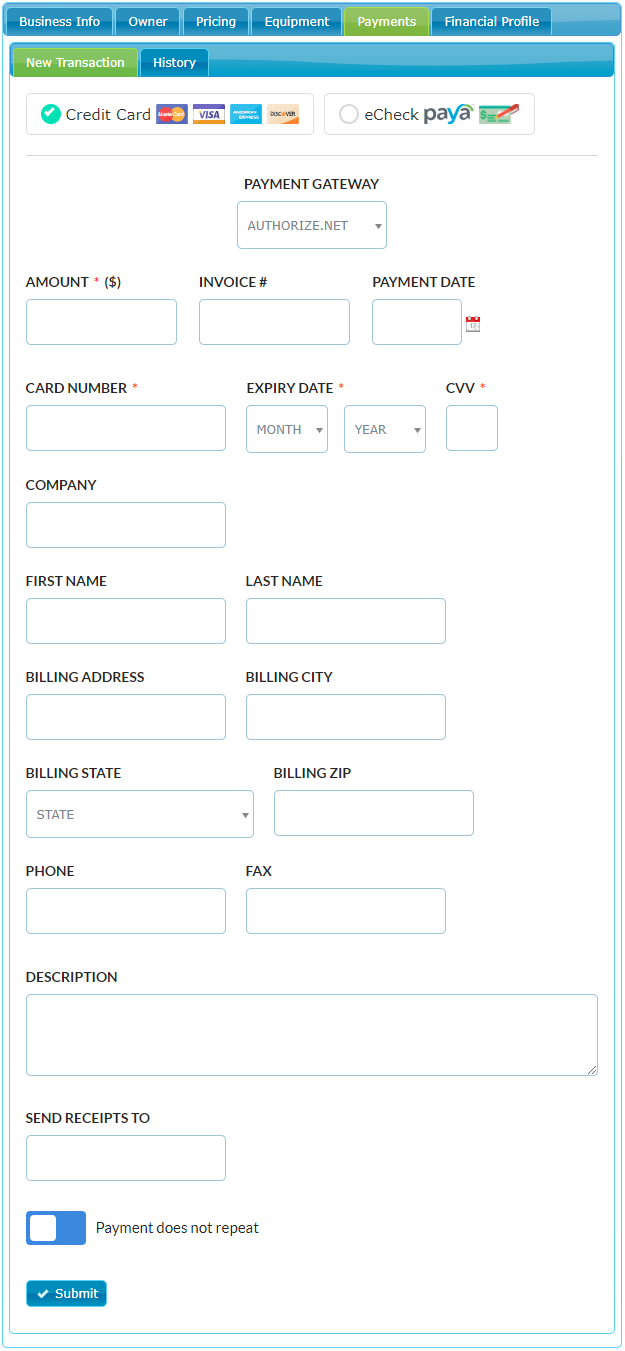

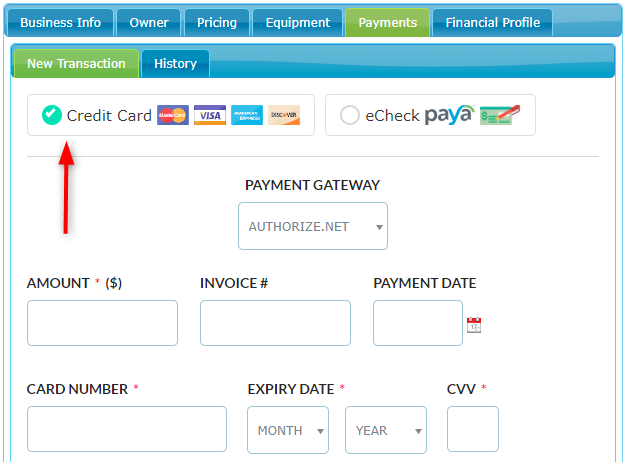

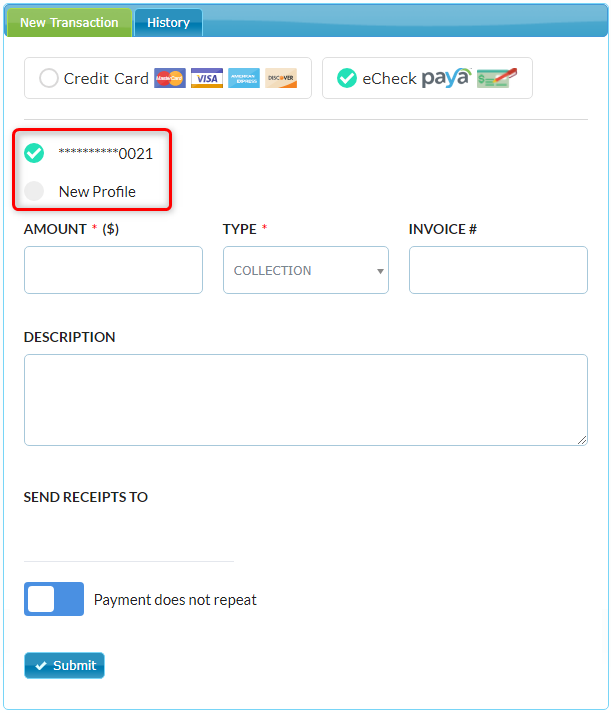

Below is a screenshot of the Payments tab with the New Transaction and History sub-tabs:

Submitting A Credit Card Transaction

To submit a new credit card transaction, select the credit card option on the New Transaction tab, select the desired Authorize.Net Gateway (if you have more than one set up), fill in the required information, and submit the form:

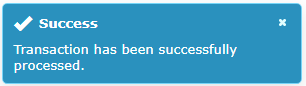

If the transaction is processed successfully, a confirmation message will be shown in the top-right corner:

Also, a receipt will be sent to the email address saved in the SEND RECEIPTS TO field.

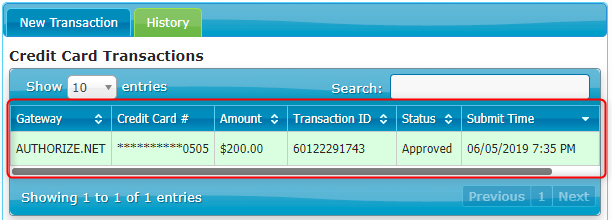

The Credit Card Transactions report on the History tab will now show a new entry for your transaction:

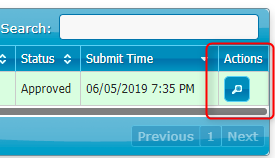

To view more detail on the transaction click on the Actions icon:

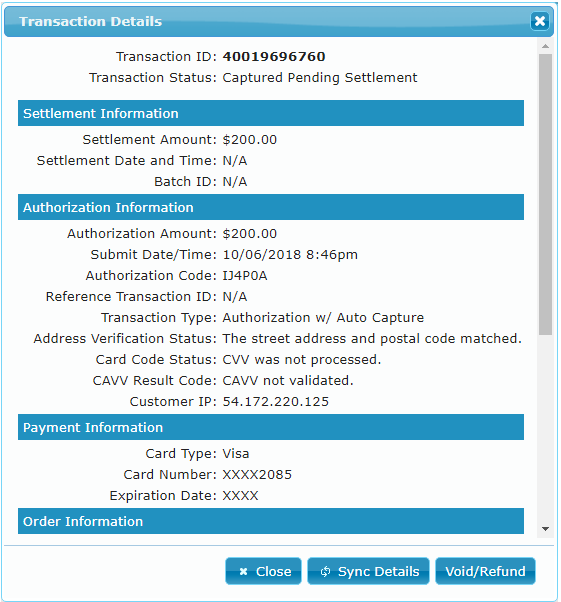

The Transaction Details popup will now appear with full details on the transaction:

At the bottom of the Transaction Details popup, you'll find the Sync Details and the Void/Refund buttons.

The Sync Details button is used to pull the transaction details from the gateway into the report manually.

Note that the transaction data is synced with the system in periodic intervals, therefore it is possible that the Transaction Details report data differs from the actual data in the gateway right at that moment.

If you suspect that the Transaction Details popup is not showing up to date information, then use the Sync Details button to get a live update from the gateway.

The Void/Refund button in the Transaction Details popup allows you to cancel a transaction or issue a refund.

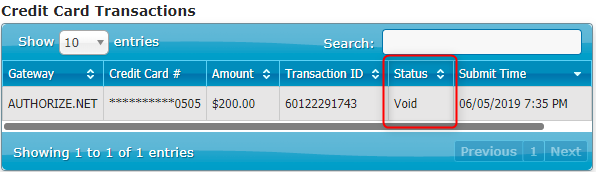

If a transaction was not yet settled, then you will be able to void it.

Voided transactions are shown with status Void in the transactions report:

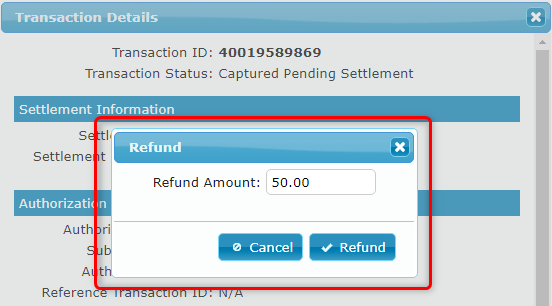

If the transaction was settled, then you will be able to issue a partial refund or a full refund:

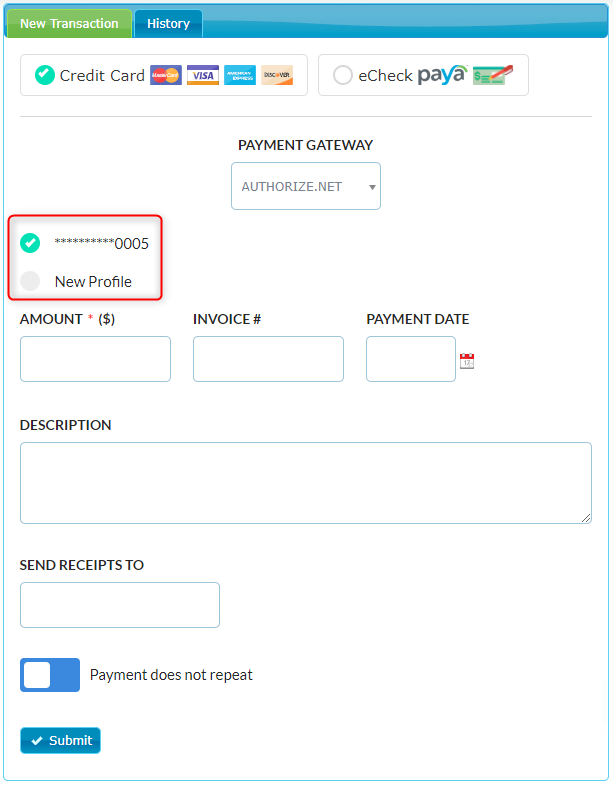

With the transaction completed, the credit card information will be saved as a new profile in your gateway, and you will be able to use that profile for future transactions.

You can also add a new profile whenever needed:

The credit card profiles can also be managed in the CRM administration on the Credit Card Profiles page.

Submitting ACH Transactions

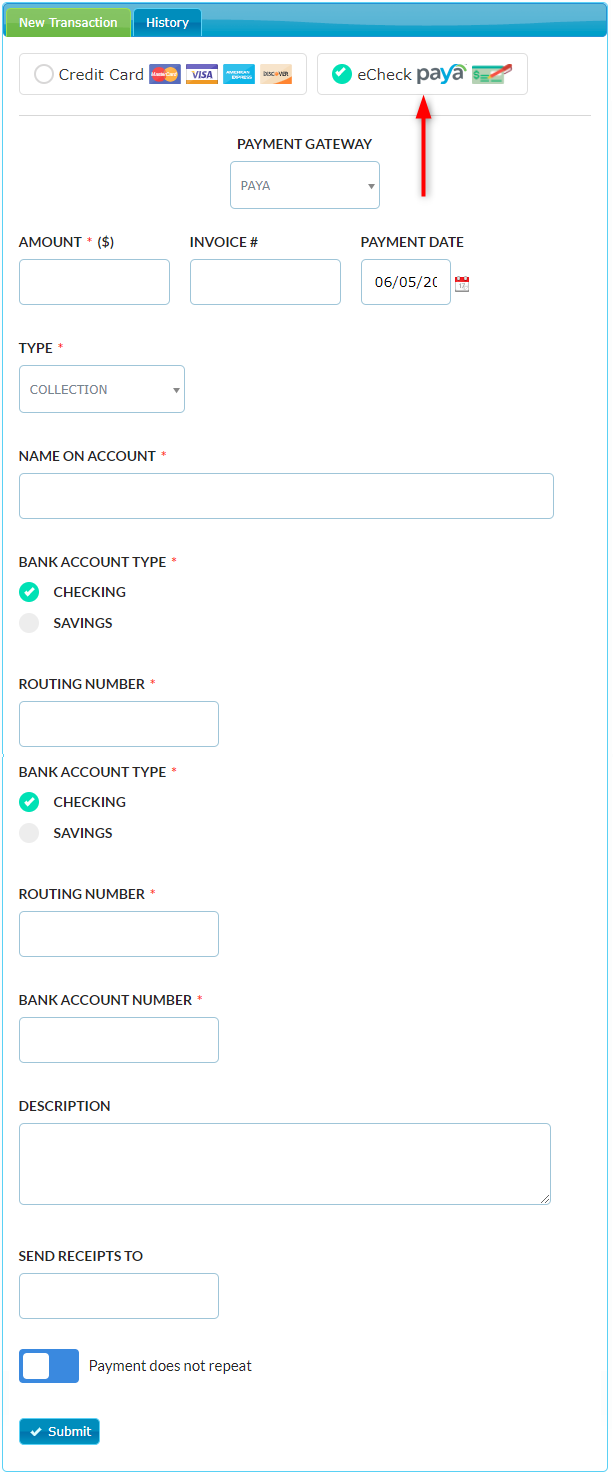

To submit an ACH transaction (either a payment or a collection) select the eCheck Paya option on the lead, select a Paya gateway (if you have more than one set up), fill in the required information, and submit the form:

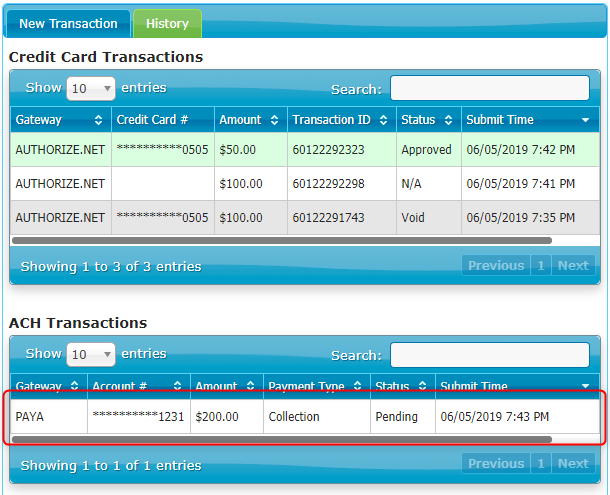

Once the transaction is submitted it will be shown in Pending status in the ACH transactions report on the History tab:

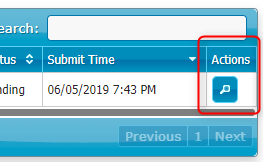

To view more detail on the transaction click on the Actions icon:

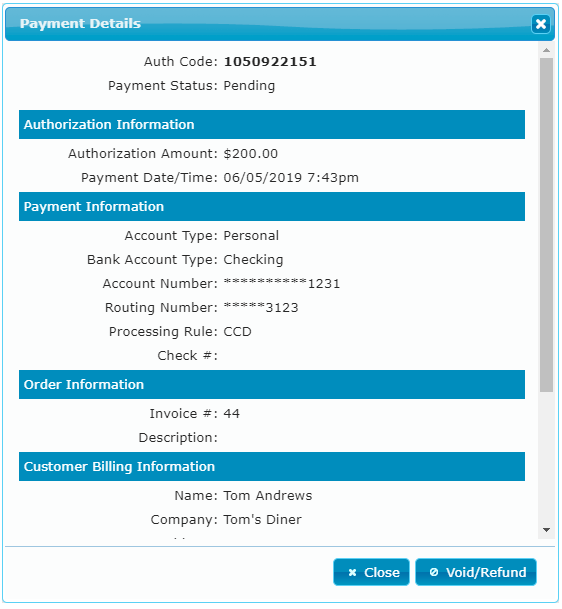

The Payment Details popup will now appear with full details on the transaction:

While a transaction is in Pending status it can be voided by clicking on the Void/Refund button.

Once the transaction has been processed, it will be possible to issue a refund if needed.

With the transaction submitted, the ACH information will be saved as a new profile which you can use for future ACH transactions (or you can add additional profiles if needed):

The ACH profiles can also be managed in the CRM administration on the Manage ACH Profiles page.

Setting Up Recurring Payments

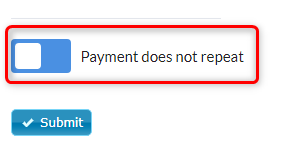

To set up a recurring payment (both credit card and ACH) click on the recurring payment toggle switch just above the Submit button:

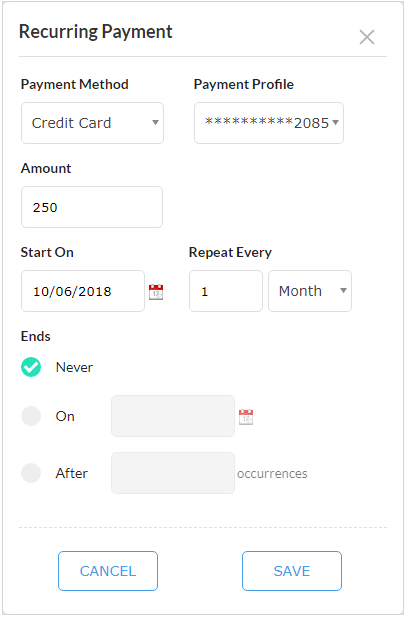

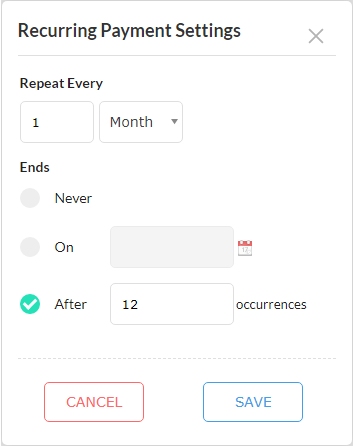

A popup window will appear where you can select the payment frequency:

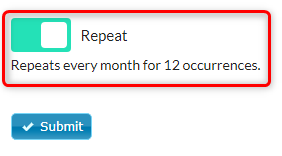

After you save your changes the toggle switch will turn green and also display the selected billing frequency:

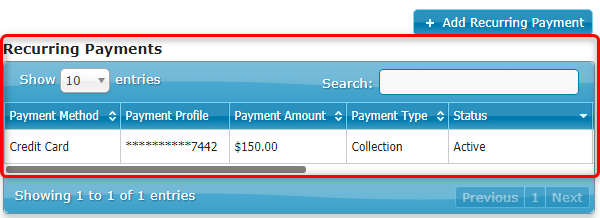

Your transaction will now be shown in the Recurring Payments report on the History tab:

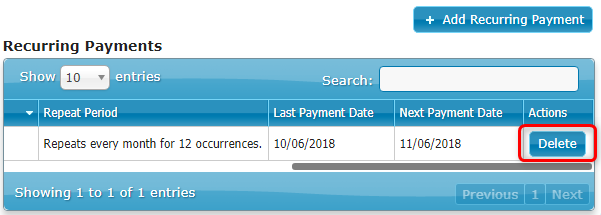

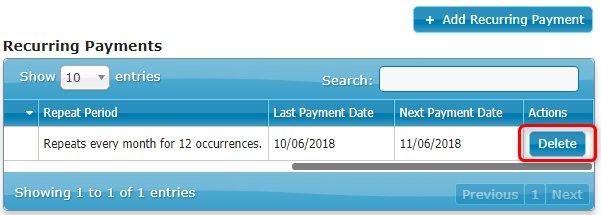

In order to disable a recurring payment, scroll right to the end of the report table and click Delete:

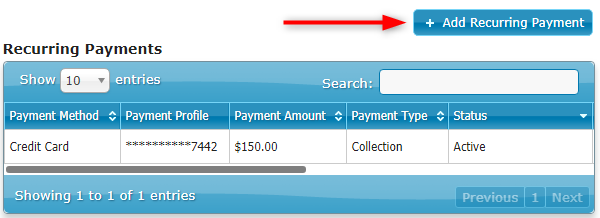

You can also add recurring payments from the Recurring Payments report by clicking the Add Recurring Payment button:

A new popup window will appear where you can select a credit card or an ACH profile, and set the payment amount and frequency: